Over 50% of Children Reported Symptoms of PTSD After Home Displacement Due to a Storm

When disaster happens and homes are destroyed, insured homeowners expect and deserve fast efficient payouts so they can restore their homes and return to normal life. However, fast and efficient is rarely the case when it comes to home insurance claims.

More often, the process is needlessly slow, tedious, stress-inducing, and is leaving serious negative mental health effects on children.

PTSD in Children: The Lasting Mental Impact of Home Displacement After a Storm

Several studies followed children after major storms and discovered that children remained displaced from their homes. As a result, children developing PTSD has become common after a storm event.

The compounding trauma of losing their homes, prolonged displacement and uncertainty all play a role in adding to the mental stress that has caused PTSD—and the amount affected is anything but small.

Over 50% of children reported symptoms of PTSD after a storm event according to a study conducted by the Society for Research Development in Children.

While the home insurance claim check process is in motion and a child is displaced from their home, their support structure is irrevocably gone—they are deprived of the comfort and familiarity of home and routine, which only makes sense that their mental health would suffer.

Data collected by the Census Bureau Household Pulse Survey shows that 1,375,143 American children were displaced by natural disasters in 2022. Of those evacuated, about one third returned home within a week, and one in six–about 229,000 kids–never returned to their homes. The rest were left in stressful temporary situations while waiting to return home.

The three main drivers of these PTSD symptoms as reported by the Pediatric Nursing Medical Journal are the terror associated with the storm, relocation time, and loss of resources. Research suggests—especially for adolescents under the age of eight—that damage can be done in as little as one day.

When a storm leaves them displaced from their home, children experience the incomprehensible loss of nearly everything they associate with safety. Their neighborhood, friends, and school may all be gone indefinitely as they relocate to temporary housing. This is a complete disruption of their lives.

Lasting additional consequences of storm displacement documented by SAMHSA include depression, anxiety, general distress, and behavioral health issues such as the noted PTSD, functional impairments, traumatic stress symptoms, and other mental disorders in disaster survivors of all ages, with children especially at risk.

In 2020, a study published in The Journal of Pediatric Psychology reported that 25% of children still had sleep disorders years after a natural disaster, and the children most affected were those who were displaced by the event.

PTSD due to home displacement following a natural disaster is devastating for children. Symptoms of PTSD include a wide range of developmental and behavioral disorders that affect their success in school and, ultimately, in life.

Something needs to be done to help restore normalcy to traumatized children quickly, but what? Let’s dive into what causes the delays in the first place and what’s currently being done to solve this problem.

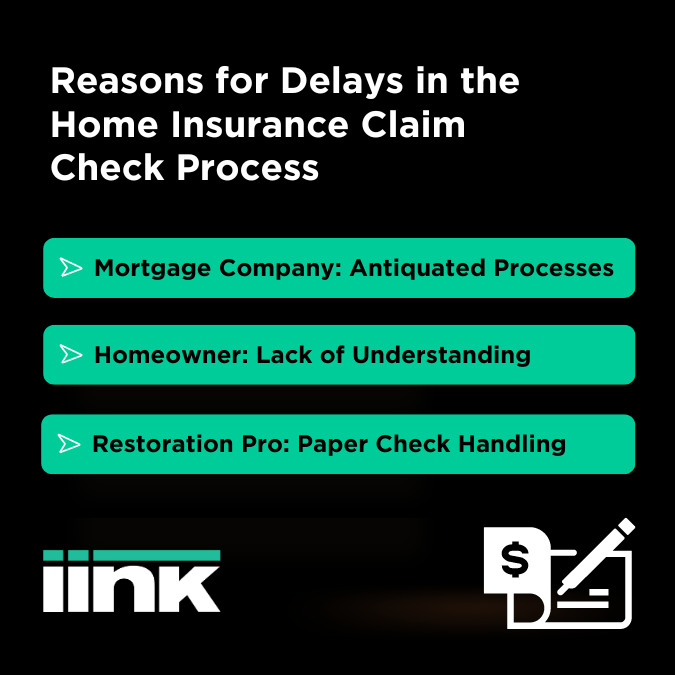

Why the Delays? Reasons for Delays in the Home Insurance Claim Check Process

When a home is destroyed and the homeowner files an insurance claim, a complex process begins. Before payment can be issued, the insurance company reviews the policy coverage, inspects the home, verifies the disaster, assesses the damage, approves the claim, and issues a paper check that must be endorsed by all stakeholders, including the homeowner, the mortgage holder, and the contractor who will be performing the home restoration work. At any stage, things can go wrong.

On the Mortgage Company End: Antiquated Processes

A big reason why the process takes so long (three weeks to three months) is due to antiquated processes with mortgage companies and loss draft providers.

Most of this delay is due to an antiquated process instituted by Fannie Mae and Freddie Mac, commonly referred to as loss draft. (A loss draft is a check issued to a homeowner for natural disaster damages that an insurer issues.) The guidelines for how these checks are issued and handled are outdated and inefficient.

Claims that are filed on a home with a mortgage are called monitored claims, and the Fannie and Freddie guidelines must be followed. This automatically makes delays closer to the three-month waiting period. Keep in mind—this is the waiting period just for the check to process. At this point, no home restoration is being made.

On the Homeowner End: Lack of Process Understanding

Most homeowners are filing for the first time and have no idea how to proceed or even what is included–or excluded–from their home insurance policy. The loss draft process is hard to understand, and it’s easy for a stressed-out homeowner to become overwhelmed by the process. Mistakes can cause additional delays.

It can take weeks and/or months for homeowners to finally get claims paid by insurance carriers under the best of circumstances–and when they often think they are just about to cross the finish line, they are confronted with another antiquated, manual, and fragmented loss draft process that delays payment. These processes can easily be automated to reduce the total time to payment.

On the Restoration Professional End: Paper Check Handling

When the claim check is finally approved, physical signatures on the check from each payee have been required–typically the homeowner, the public adjuster (if the homeowner hires one), the restoration contractor, and the mortgage company are required to endorse checks. The traditional process is to send the paper check through the mail to the mortgage holder before restoration contractors can be paid.

To make matters worse, checks get lost in the mail and have to be re-issued, or the check approval is delayed by the mortgage holder for internal reasons.

The entire claims process is slow and unwieldy at best. In the digital age, children are unnecessarily being put at risk over paperwork hold ups when more efficient processing is available.

A Step in the Right Direction

So, where do we go from here? Seeing the negative impact this issue presents, it’s clear that the insurance claims process needs to change. Unfortunately, not enough is being done quickly enough. Slow home restoration has been a problem for decades.

At iink, we’re on a mission to help to solve this problem at large by working with loss draft providers and mortgage banks. In addition, we:

1. Handle mortgage companies on behalf of payees: property owners, contractors, public adjusters, and attorneys.

2. Allow payees to remotely endorse and deposit checks on the iink app.

3. Get contractors the funds they need to make repairs faster (while they wait to receive checks) through our Advance Funding program.

If you are a loss draft provider, mortgage servicer, insurance carrier, or policy maker interested in learning more about how iink can solve these problems and more for a better tomorrow, please contact us with attention to Tom McGrath.

_1.png?width=352&name=millie_on_jeepin_it_real_(1)_1.png)